Establishment of the Board 4. A 49391 Employees Provident Fund Conduct And Discipline Rules 1993 - PU.

Employees Provident Fund Epf Kwsp Malaysia Family My

ACT 452 EMPLOYEES PROVIDENT FUND ACT 1991 Part I PRELIMINARY SECTION 1Short title and commencement 2Interpretation Part II THE BOARD AND THE INVESTMENT PANEL SECTION 3Establishment of the Board 4Membership of the Board 5Alternate members 6Tenure of office 7Resignation and revocation 8Vacation of office.

. Employees Provident Fund Act 1991 Act 452 regulations and rules by Malaysia unknown edition It looks like youre offline. 1 This Act may be cited as the Employees Provident Fund Act 1991. 9678903938 1 eBook Free in pdf kindle epub tuebl mobi audiobook 1 New Release 2020.

Or b being a non-citizen. Section 2 of the EPF Act spells out the definition of an employer as follows. All employees in Malaysia whohave reached the age of 16 and have been working under a service contract whether explicitor implied oral or written must be enrolled as an EPF member.

EMPLOYEES PROVIDENT FUND ACT 1991 EMPLOYEES PROVIDENT FUND AMENDMENT OF THIRD SCHEDULE ORDER 2004 IN exercise of the powers conferred by section 74 of the Employees Provident. EMPLOYEES PROVIDENT FUND ACT 1991 ARRANGEMENT OF SECTIONS P ART I PRELIMINARY Section 1. Employees Provident Fund Act 1991 ACT 452 Regulations and Rules 1993 International Law Book Services Kuala Lumpur Malaysia p.

As of 31 December 2012 EPF has 136 million members of which 64 million are active contributing members. ACT 452 EMPLOYEES PROVIDENT FUND ACT 1991 Part I PRELIMINARY SECTION 1Short title and commencement 2Interpretation Part II THE BOARD AND THE INVESTMENT PANEL SECTION 3Establishment of the Board 4Membership of the Board 5Alternate members 6Tenure of office 7Resignation and revocation 8Vacation of office. EPF is governed by the Employees Provident Fund Act 1991 EPF Act.

Employees Provident Fund Act 1991 Act 452 Regulations And Rules As At 15th November 1991. Tenure of office 7. In this Act unless the context otherwise requires-- additional amount means the amount payable under section 58.

In Malaysia the Employees Provident Fund Act 1991 is the act regulating the EPF. 2 This Act shall come into force on such date as the Minister may by notification in the Gazette appoint. Section 2 In this Act unless the context otherwise requires - additional amount means the amount which may be paid under section 58.

The purpose of this Act is to provide retirement and old age benefits such as Provident Fund Superannuation Pension Deposit Linked Insurance etc. Provident Fund is a mandatory saving by an employee during the years of his employment. Section 2 of the EPF Act spells out the definition of an employer as follows.

Employees Provident Fund Act 1991 Act 452 regulations and rules. An Act to provide for the institution of provident funds 23pension fund and deposit-linked insurance fund for employees in factories and other establishments. A 17893 Employees Provident Fund Regulations 2001 - PU.

Act 452 English Employees Provident Fund Act 1991 Regulations. Aemployees who are Malaysian citizens. EBook Download BOOK EXCERPT.

Membership of the Board 5. TheEmployees Provident Fund Malaysia administers this Act. Short title and commencement 2.

Employer means the person with whom an employee has entered into a contract of service or apprenticeship and includes-. Short title extent and application41 This Act may be called the Employees Provident Funds and Miscellaneous Provisions Act. A is physically or mentally incapacitated from engaging in an employment.

The provisions in section 55b of the principal act that prohibit a member who has attained 55 years of age from withdrawing contributions made after attaining 55 years of age until he has attained 60 years of age will not apply to a member who. Čeština cs Deutsch de English en Español es Français fr Hrvatski hr 中文 zh. The rate of monthly contributions specified in this Part shall apply to the following employees until the employees attain the age of sixty years.

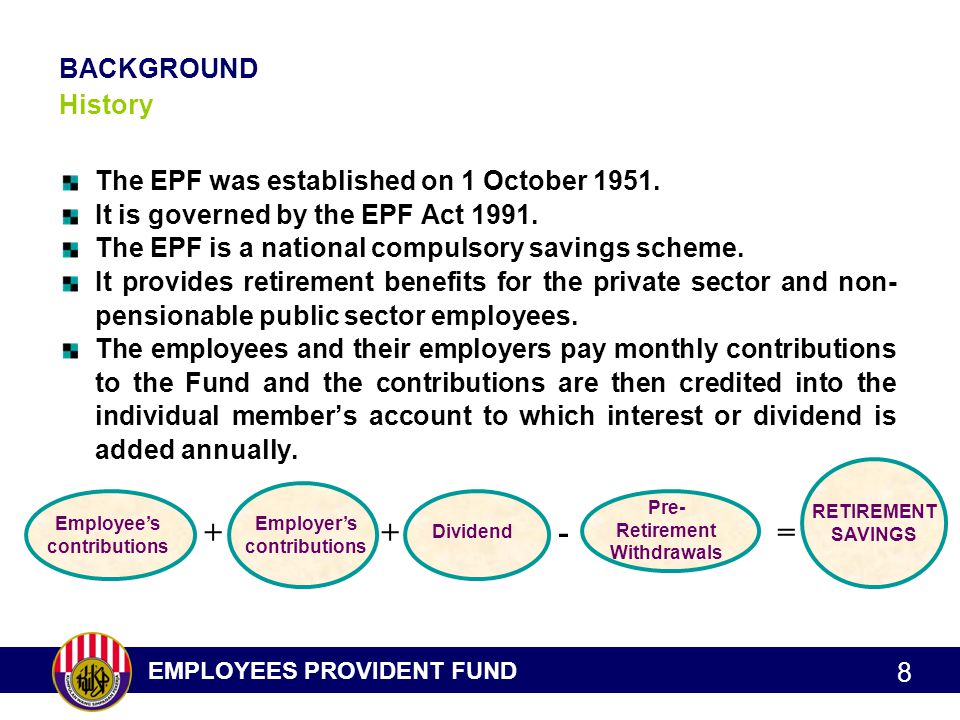

With the intent to protect the interest of workers recruited in factories and other establishments. Interpretation P ART II THE BOARD AND THE INVESTMENT PANEL 3. The EPF Act 1991 requires employees and their employers to contribute towards their retirement savings and allows workers to withdraw these savings at retirement or for special purposes before then.

The extent of the employers obligation to. Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as the EPF a social security fund established under the EPF Act to provide retirement benefits to employees working in the private sector. The Employees Provident Fund EPF is one of the worlds oldest provident funds.

Established in 1951 we help the Malaysian workforce to save for their retirement in accordance to the Employees Provident Fund Act 1991. BE it enacted by Parliament as follows 1. Employees Provident Fund Rules 1991 - PU.

Vacation of office 9. EPF is governed by the Employees Provident Fund Act 1991 EPF Act. Employer means the person with whom an employee has entered into a contract of service or apprenticeship and includes-.

This Act shall come into force on such date as the Minister may by notification in the Gazette appoint. Employees Provident Fund Act 1991 Act 452 regulations and rules by Malaysia 1992 International Law Book Services edition in English. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1.

In accordance with the Governments announcement on the reduced statutory contribution rate of employees share from 11 to 8 in accordance with the Third Schedule below are the amendments to Part A and Part B of the Third Schedule of EPF Act 1991 Amendment 2008. Today we at the EPF continue to refine our vision to not only stay relevant but to create a better retirement for all our members. 1-77 Malaysian Employment Legislation 2007-10-09 CCH Asia Pte Limited No.

This Act may be cited as the Employees Provident Fund Act 1991. Resignation and revocation 8.

Employee Provident Fund Act Epf Calculation Youtube

Employees Provident Fund And Miscellaneous Provisions Act Pdf Free Download

Pdf From The Employees Provident Fund Epf To The National Social Protection Fund Nspf The Case Of Malaysia

The Employees Provident Funds And Miscellaneous Provisions Act Ppt Download

Pdf Employees Provident Fund Concept Peatix

Summary Of Case Study On Employee Provident Fund Of Malaysia

The Employees Provident Funds And Miscellaneous Provisions Act Ppt Download

Employee Provident Fund How To Check Epf Balance Online Withdraw Pf Money And More 91mobiles Com

Employee Provident Fund Act Otosection

The Employee Provident Funds 1952 A Guide Ipleaders

Summary Of Case Study On Employee Provident Fund Of Malaysia

Ilgl 06 A Employees Provident Fund And Miscellaneous Provisions Act 1952 Youtube

I Citra Epf Says No Provision In Employees Provident Fund Act That Allows Withdrawals Under Natural Disasters Natural Disasters Disaster Response Disasters

Industrial Management Academy Ppt Download

Employees Provident Fund Epf Malaysia Ppt Video Online Download

Dhr 110 Week 12 13 Employees Provident Fund Act 1991

Edli Provides Relief To Families Of Epfo Members During Pandemic Mint

Employee Provident Fund Act Otosection